Supporting the green economy is more than being informed—it’s about following through and “voting with your dollar” as we call it. Where you shop and what you buy when you do sends a message to business owners. And it helps sustainable businesses stay afloat in a deal-driven market. Here are our favorite sustainable shopping tips.

As media attention causes more and more consumers to become aware of the troublesome levels of toxins in certain kinds of fish, the seafood industry is starting to feel the effects.When the Food and Drug Administration (FDA) and Environmental Protection Agency (EPA) issued an advisory in March 2004…

By Green America

By Green America

Market your yard sale, grab friends and family, and more!

By greenamerica

By greenamerica

Farmers markets aren't the only way to support local farms—you can make the most of your grocery store, too.

By Anya Crittenton

By Anya Crittenton

Hoping to save money while reducing packaging waste? Buy in bulk!

By Kendall Lowery

By Kendall Lowery

Learn about the dangers of fiberglass mattresses and make sure your mattress is safe and nontoxic.

It’s easy to find deals online, but is online thrifting greener than the brick-and-mortar option?

By Kendall Lowery

By Kendall Lowery

When you’re out in the garden or park this summer, skip the toxic chemicals—choose natural skincare options instead.

By Sytonia Reid

By Sytonia Reid

Avoid climate hazards in your backyard with these eco-friendly lawn swaps.

By Sytonia Reid and Beth Porter

By Sytonia Reid and Beth Porter

Following workers’ leads may sound like a passive task, but it’s the opposite. Listening to workers requires community members to actively listen and respond.

By Charlotte Tate

By Charlotte Tate

Small businesses across the US were hit hard by the coronavirus, but Black-owned businesses felt it the most. We can use our collective power to show corporations what our values are.

By Sytonia Reid and Mary Meade

By Sytonia Reid and Mary Meade

Victory

Smuckers removes GMOs and high fructose corn syrup from Uncrustables, its very popular peanut butter and jelly product for kids.

Green America's GMO Inside campaign has mobilized tens of thousands of consumers to ask Smuckers to remove GMOs from its products.

Green Living

Take Action

Green America strives to provide informative and engaging webinars that help individuals make positive changes in their daily lives. Join us as we explore ways to create a more sustainable future for ourselves and the planet.

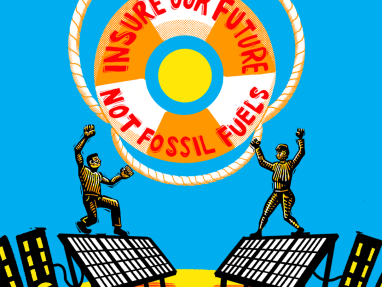

Many large insurers are scaling back policies and raising rates in climate-vulnerable areas, all while insuring fossil fuel projects and investing in fossil fuels.

Trader Joe’s received one of the worst scores on Green America’s retailer chocolate scorecard; it shares very little information about what they are doing to address…

Related News

Guest post from Casper Ohm of Water-Pollution.org.uk, an outlet intended to raise awareness of the alarming levels of water pollution in our planet’s oceans.

With 1 million extra tons of trash per week being thrown away by Americans around…

Though nobody likes having tough conversations around the Thanksgiving table, we at Green America think that having family and friends over is a great time to talk about sustainable Thanksgiving food. These dishes can spark conversations about…

Last June, Amazon.com Inc. purchased Whole Foods Market Inc. for $13.7 billion. This was one of the most widely talked about mergers of 2017 because of the possible impacts it could have on the grocery industry. Since then, Whole Foods has undergone…

Let us inspire you!

Take action against corporate greed, learn new ways to reduce your impact on the planet, and discover green products you never knew existed.