Climate the Top Sustainability Concern; Ending Workplace Discrimination Tops Shareholder Resolutions; Community Development Investments Soar

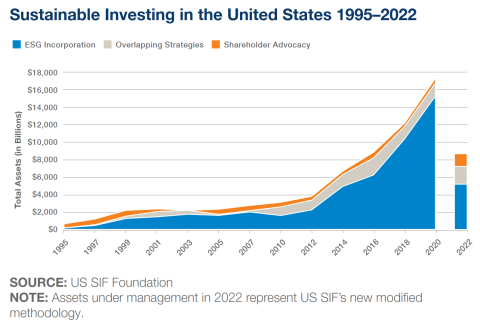

The Forum for Sustainable and Responsible Investment (US SIF) documents the assets involved in socially responsible investing strategies, also known as ESG (environmental, social, and corporate governance) investing along with other key developments in sustainable investing. The newest, biannual Report on U.S. Sustainable Investing Trends, released December 2022, tallies sustainable investing at $8.4 trillion.

The new report reflects a decrease in ESG investing for reasons that stand to benefit the continuing development of sustainable investing over time. First, the latest report applied a more stringent methodology to identify assets involved in ESG investing to ensure that specific ESG criteria are applied to all assets counted. This more detailed approach and level of disclosure is needed given the recent, rapid and sizeable increase in firms claiming to integrate ESG considerations.

Secondly, US SIF also attributes the decrease in their ESG-investing tally over that in the 2020 report to action by the Securities and Exchange Commission (SEC) that mandates greater disclosure of funds’ ESG criteria. Both the change in report methodology and action by the SEC bode well for ensuring a more accurate count of the dollars involved in sustainable investing.

Highlights of the report include:

- Climate and carbon emissions are the top ESG concern of both asset managers and institutional asset owners; fossil fuel divestment ranked fourth among the ESG factors that asset managers address.

- Workplace fairness, especially focused on ending ethnic and sex discrimination, emerged as the top concern in shareholder resolutions.

- Community development investing, benefiting economically marginalized communities, continued to rise, reaching $458 billion; this is an increase of 72% since the last report in 2020 and a $600% increase over the last decade.

- After climate-related criteria, the top issues for asset managers focused on military/weapons; tobacco; and anti-corruption.

- After climate-related criteria, the top concerns for institutional investors focused on conflict risk (terrorism or repressive regimes), corporate board issues, sustainable resources/agriculture, and tobacco.

Green America has resources to keep you updated all year long on socially responsible investing, better banking, and shareholder action. Together, we can vote with our dollars to support people and the planet.