Don’t wait for “perfect market conditions” to set up an employer-sponsored retirement plan; that day may never come! Even in a turbulent market, today is still the day to commit to setting up a retirement plan for your employees if you don’t already offer one. An IRA that includes socially responsible (SRI) mutual fund options can even be set up for one employee.

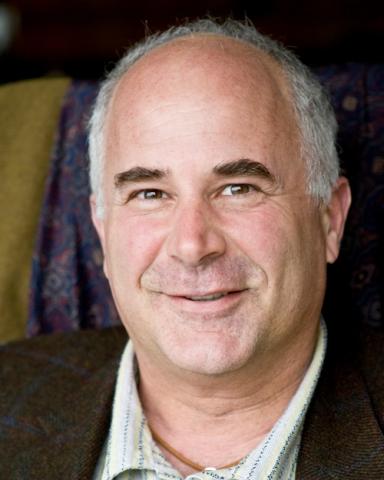

Green Business Network Director Fran Teplitz spoke with long-time, certified Green Business Network member Rob Thomas, founder of the Social(k) retirement plan platform, about costs that employers should keep in mind when selecting a retirement plan. Social(k) {GBN} works with employers – including small businesses – to figure out what kind of retirement plan makes sense to provide.

Rob explained that given the wide range of SRI options available across all types of mutual funds, it’s easier than ever for employers and employees to find funds that meet their financial goals and that match their values or mission.

What is often harder for people to understand is the cost structure. And that lack of understanding can lead to inertia.

“Many people don’t want to discuss pricing because retirement plan structures are new to them, but it’s actually not that hard to grasp, although there are a number of different parts,” Rob assures. “Green Business Network {GBN} members are already committed to environmental sustainability and social justice, so opting for a plan in keeping with those values makes sense. Green business leaders just need to take the next step and get comfortable with understanding the costs so they can move forward,” he added.

Fran: Yes, green businesses gravitate toward SRI or ESG (Environmental, Social, Governance)-focused retirement plans rather than those with only conventional funds that invest in fossil fuels or for-profit prisons. You believe that understanding costs is a bigger challenge for employers than understanding the funds available. What are the costs to understand?

Rob: There are two types of fees, hard dollar fees per employee and for administration, these are clear, and the employer receives an invoice for them. Then there are “soft” fees that are based on the assets involved and these are not as obvious. Mutual funds, for example, have expense ratios, a fee for the fund to do its work. The platform provider, also charges a fee, as will the plan advisor if one is needed to help select funds and review the overall portfolio and the record keeper. These are all legitimate costs but may be harder to track.

Fran: So where does one find these fees spelled out?

Rob: These fees are provided online by the retirement plan, typically in a summary of the plan that explains its 408b form that the government requires for disclosure of retirement plan fees. This form includes a description of services and the associated fees. The plan advisor and plan sponsor (usually the employer) need to pay attention both to fees and to the financial returns of the investments to help identify the best-suited plan.

I’d say that ESG mutual fund fees in general can run 25 to 50 basis points – that’s how fees (i.e., the expense ratio) are measured and is simply another way of saying .25% to .5%. The expense ratio is determined by dividing the fund’s expenses by the value of the fund’s assets. {According to Investopedia, The average expense ratio for actively managed mutual funds is between 0.5% and 1.0%. For passive index funds, the typical ratio is about 0.2%.}

Some ESG funds might have greater fees because they are smaller funds, but research has shown that an ESG approach can reduce financial risk and lead to better outcomes in the world. They can definitely be a better investment than lower cost, “monster-sized” funds.

Fees for a plan advisor who provides oversight, answers questions, and handles administrative details are usually around 50 basis points.

The record keeper, an essential role that tracks where individual employee’s assets are invested, is often a flat fee between $2,000 - $5,000 per year.

The typical platform fee for the user experience is approximately $3,000.

Fran: This is very helpful information, especially for smaller employers that have no HR person. It’s great to know there are firms like Social(k) dedicated to people and the planet that can make it easier for businesses to help their employees save for the future.

Rob: The language around retirement plans scares people off, but if you spend some time on it, it’s not too hard – and it’s really important to do. Saving for retirement will make your life better and employers can use retirement platforms like Social(k) to make it a smooth process for everyone.

To learn more about retirement planning, see Green America’s free guide: Plan for a Better Future: How to Add Socially & Environmentally Responsible Investment Options to an Employer’s Retirement Plan

To learn about Social(k) visit: socialk.com

Green America is not an investment adviser nor do we provide financial planning, legal, or tax advice. Nothing in our communications or materials shall constitute or be construed as an offering of financial instruments or as investment advice or investment recommendations.