Emily Moore of Minneapolis was having problems with Citibank. No, they weren’t pulling any of the common predatory foreclosure tricks on her—they hadn’t wrongfully foreclosed due to a processing error, or used predatory fee-padding techniques, or strategically misapplied her payments.

Moore’s problem was that they were doing one of these things to her friend Rose McGee. A longtime Minneapolis community leader, McGee was unable to make her payments after being laid off from her job at a local nonprofit.

With her financial situation changing drastically, McGee immediately approached Citibank, her mortgage holder, hoping to work with the bank on a payment solution that could keep her in her home of 18 years. While it entered into mortgage modification negotiations with McGee, Citibank simultaneously started taking steps to foreclose on her home unbeknownst to her—a practice known as dual-tracking, which was recently made illegal after it was used extensively by banks during the mortgage crisis. The bank sold her home without notifying her.

“I was outraged to know that it was the same bank that I had a mortgage with,” says Moore. “It made me feel like I needed to do something.”

So Moore contacted the Citibank loan officer who had previously helped her. She called customer service, and she wrote and faxed letters asking the bank to provide better service to McGee.

After receiving no meaningful response, Moore began to look into taking her own mortgage away from Citibank. She knew that every mortgage payment she made to Citibank went to lining the pockets of the institution causing her friend’s suffering—and undoubtedly that of others.

“The failure of CitiMortgage to communicate effectively with Ms. McGee … makes me question whether I can continue with CitiMortgage myself,” Moore wrote in a letter to the bank. “I expect more from my mortgage company.”

Instead of financially propping up a bank that was hurting people, Moore wanted to support a financial institution that benefited her community.

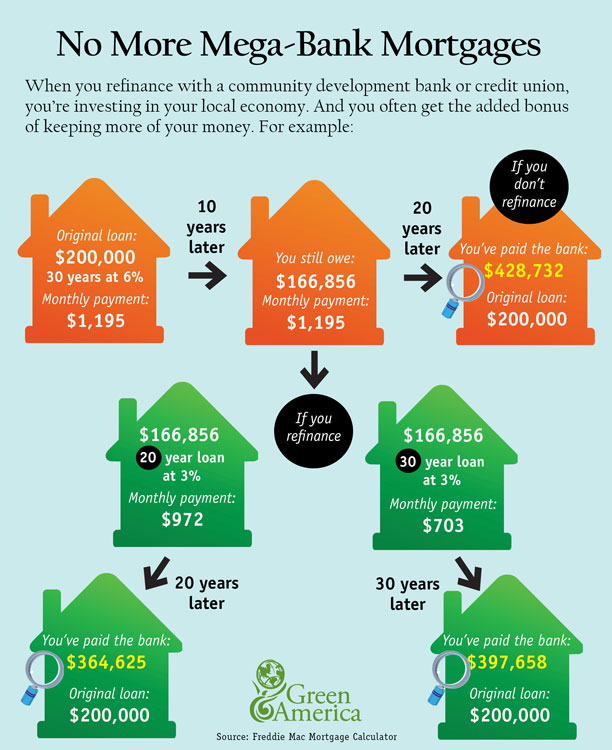

If you haven’t refinanced in the last few years, now is the time to consider it and break away from Wall Street banks. And if you’re thinking about becoming a new homeowner, consider getting your mortgage through a community development bank or credit union that will use your money for good. Obtaining or refinancing a mortgage loan from a community development financial institution (CDFI) has several benefits: These institutions exist to support communities and the environment, so your money will help people and causes you care about, rather than building coal-fired power plants or financing mountaintop-removal mining. They strive to provide individualized, top-level customer service, rather than unfairly foreclosing on mortgageholders. And you’ll enjoy an interest rate competitive with what you’ll get at one of the mega-banks.

“CDFIs model the kind of banking we need more of from coast to coast,” says Fran Teplitz, Green America’s director of social investing. “These institutions are committed to grassroots economic prosperity, and they give hope and opportunity to individuals and neighborhoods that are either ignored or exploited by the big banks.”

Better Banking

CDFIs are certified by the US Department of the Treasury as having a “primary mission” of promoting community development, which means they have a federal mandate to provide loans and other financial services to historically underserved populations. They also often have community programs to help their loans succeed—such as financial advising, small-business counseling, low-income tax clinics, and mortgage foreclosure mitigation programs.

Hope Credit Union, for example, is a Gulf Coast CDFI that has a number of counseling programs to help both members and non-members stay in their homes. Hope has foreclosure-prevention services for people facing financial difficulties, as well as preventative counseling for new homeowners to help their home loans succeed.

“We are here for what is best for [our members],” says Hope’s Shirley Bowen. “They’re not just a person coming in, getting an immediate decision, and being sent on their way. We want to know what is best for them, and we want to put them in the product that is best for them.”

After years of working with a big bank, learning about what CDFIs are doing in your community could infuse a good dose of optimism into your life.

“We have affordable housing initiatives, we have business lending so we can invest in loans that do job creation,” says Dave Prosser, vice president of community development at Freedom First Credit Union, which offers mortgages throughout Virginia. “We try to live up to our slogan in all aspects of our business: ‘Where people bank for good.’”

Thinking of Refinancing?

Are you considering refinancing an existing mortgage to get it out of the hands of a mega-bank? According to conventional wisdom, it can be financially advantageous to refinance when you can reduce your interest rate by at least two percentage points, says Carol Chernikoff, chief lending officer at Alternatives Federal Credit Union. However, she cautions, everyone’s case is different.

“Refinancing generally costs money because of the fees involved, so it’s important to make sure you are reaching your financial goals when spending that money,” she says.

It’s possible to save money in the long term when refinancing but be hit by heavy closing costs up front. Refinancing a mortgage generally costs $4,000 to $9,000 in closing costs, depending on your state, financial institution, and home. This amount includes both third-party costs—like the cost of an appraisal and government taxes and fees—and in-house fees, which are what the bank or credit union charges for its services. It’s important to shop around, as rates can vary greatly by institution, and these in-house fees are often negotiable.

Here’s what you need to know to put your mortgage money to work for communities through a CDFI: Four Steps to a Better Mortgage

1. Find a CDFI: The best option is to find a CDFI that is working in your city, county, state, or region. Community development banks and credit unions exist in and serve areas all across the country. If you can’t find a CDFI in your region, a community bank or credit union is a good second option (see resources below).

2. Contact the CDFI: Intrigued? Call or visit your chosen CDFI to find out how to obtain or refinance a mortgage.

“We generally meet with people before they’re even ready to apply to give them a sense of what [the mortgage or refinancing process] means,” says Carol Chernikoff, chief lending officer at Alternatives Federal Credit Union.

You’ll want to discuss comparable interest rates and fees—which are the numbers that will help you decide whether a new or refinanced mortgage makes financial sense for you.

“The difference with coming to a [CDFI] in general is you will have more personal attention paid to your individual situation,” says Chernikoff. “You won’t just have numbers punched into a spreadsheet without any discussion on where the person wants to be in one years, five years, or ten years.”

During this initial discussion, be sure to ask the loan officer about whether the CDFI will keep your mortgage “in house,” as opposed to selling it to a larger—and potentially less socially responsible—company. Just because you’re banking with a CDFI doesn’t mean they won’t sell your mortgage off to another entity.

3. Fill out an application: The loan officer won’t be able to speak to your specific situation in detail until after you’ve turned in your new loan or loan refinance application. Many financial institutions allow you to apply online. You will need to provide basic information on income and assets, and give permission for them to pull your credit report.

4. Start the relationship! With your application in hand, the loan officer will be able to help you get down to the nuts and bolts of what moving your mortgage will mean for you. If you do decide to obtain a new loan or refinance with this institution, the officer may need additional information, such as an appraisal on your home in the case of a loan refinance.

Your process will depend a lot on the financial institution you work with and your financial situation. Your credit score will help determine the interest rate you can get, for example. If you’re refinancing, the appraised value of your home will show you how much your home has gained or lost in value since you took out your first mortgage, which factors into your refinance eligibility.

Regulations may vary by state, which means that there are relatively unique laws and loan options affecting you and your financial institution.

“One of the things about mortgages is that they are like snowflakes—there are never two alike,” says Prosser.

CDFIs: Willing to Stick By You

Once closing costs are taken into account, refinancing with a CDFI may or may not get you a better deal than the loan you already have. Keep in mind, however, that if you get an in-house mortgage with a CDFI, they will be much more likely to work with you should you ever have trouble making your payments, instead of jumping to foreclose as the mega-banks often do.

“When someone has trouble paying, we directly contact them—we don’t just send notices,” Chernikoff says. “We try to stay in personal communication. We have them come in and explain what the financial challenges are.”

The credit union then works with the borrower to find a mutually agreeable solution, she says.

For example, Shannon Sullivan, past Alternatives member and part of the Naval Reserve notes that she “really found out how caring Alternatives is” after she was called up to active duty after Hurricane Katrina.

“Navy pay is only a fraction of what I make as a nurse practitioner,” she writes, which caused her to panic over how she’d pay her mortgage on a reduced salary. So she called the credit union. “In 24 hours, Alternatives had arranged for me to pay interest only on smaller loans, and to forebear my mortgage until I returned from active duty… Because of Alternatives, I still have my home,” she writes.

This kind of teamwork attitude towards resolving payment issues is a far cry from the nightmare that Emily Moore’s friend has gone through in Minneapolis. Moore was able to move her own mortgage away from CitiBank in protest and chose Affinity Plus Credit Union, a local institution. “I was able to fold in a couple of other loans, and still my payment is about $100 lower than what I was paying to Citi- Mortgage,” Moore says. “I feel absolutely wonderful about having moved it.”

CitiBank sold Rose McGee’s foreclosed home to Fannie Mae, and she is still fighting to get it back. “I have been employed since January 2012 and am willing to pay,” she wrote in a letter delivered to Fannie Mae in April of 2013. “Why then would CitiMortgage and Fannie Mae choose to take my home and have it sit empty, further reducing [the] property value of the neighborhood?”

Choosing foreclosure over sincere payment negotiations is not something you would likely see a CDFI do.

The money you put into your home represents a huge investment on your part. Obtaining or refinancing a mortgage through an institution with strong ties to your community can protect that investment from predatory practices, while also strengthening your local economy. When it’s time to obtain or refinance a mortgage, consider a CDFI or green bank, instead of a mega-bank that has likely caused some of your neighbors to put up foreclosure signs.